Car Insurance Rates By State

Of course other factors will determine what your final rate may be but ultimately your location will be the biggest factor in what you pay.

Car insurance rates by state. The average cost difference between full and minimum coverage. States set car insurance regulations and minimum insurance requirements which can have a major impact on the rates paid by residents. As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums. The single largest determining factor of what you pay for car insurance is where you live.

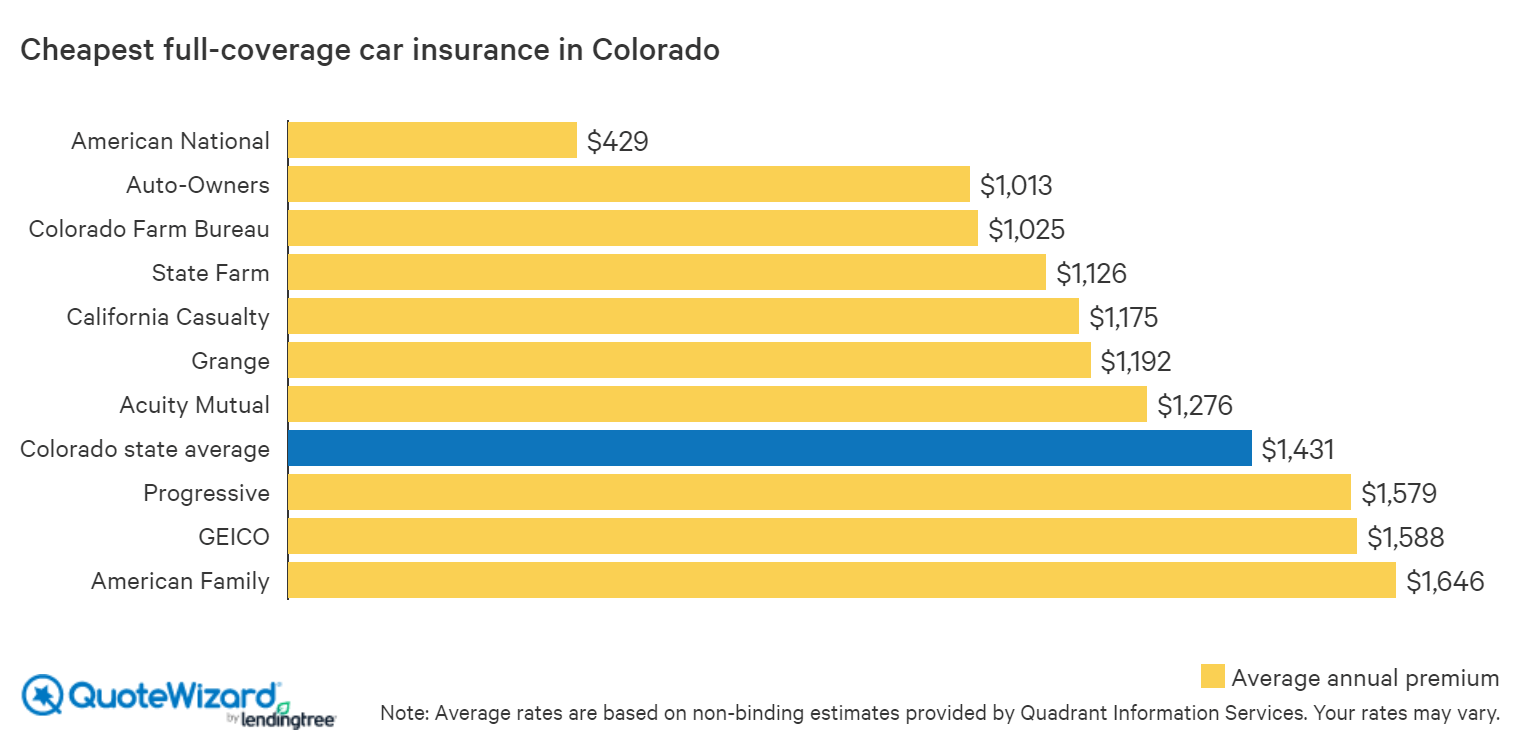

The rates shown here are for comparative purposes only and should not be considered average rates available by individual insurers. Car insurance by state also varies with the zip code taking into consideration the prevalence of vehicle theft and other crime rates where the insured lives compared to the rest of the state. Some states have unusual car insurance requirements such as high limit personal injury protection which can significantly raise rates. Another reason is that your location is chief among the factors car insurance companies use when setting rates.

If youre moving from one state to another car insurance might be low on your list of logistical issues. Every state has its own car insurance laws and thats one reason why car insurance rates by state vary dramatically across the country. Because car insurance rates are based on individual factors your car insurance rates will differ from the rates shown here. The state most widely.

Michigan is the most expensive state to buy car insurance for both minimum 5282 and full coverage 8723 policies due to its unique requirement of no limit personal injury protection. The 10 states with the cheapest car insurance costs. This is because a number of factors. Based on the number and severity or cost of car insurance claims within the area insurers assign zip codes different risk levels.

How to handle car insurance when moving to a new state. Car insurance rates are set based on a variety of rating factors including age gender profession driving history credit score coverage level and specific location. Maine is at the other end of the spectrum with the cheapest rates in the country at just 1268 for full and 489 for minimum coverage amounts. States that require more coverages such as.

Car insurance rates are on the rise for about 56 million drivers across the united states in the first half of 2020 according to data gathered by sp financial services.